Token Vault

To reduce the opportunity cost of providing liquidity, Foil will also offer tokenized shares for passive liquidity vaults which will be composable throughout DeFi to be used in external liquidity pools, lending protocols, etc.

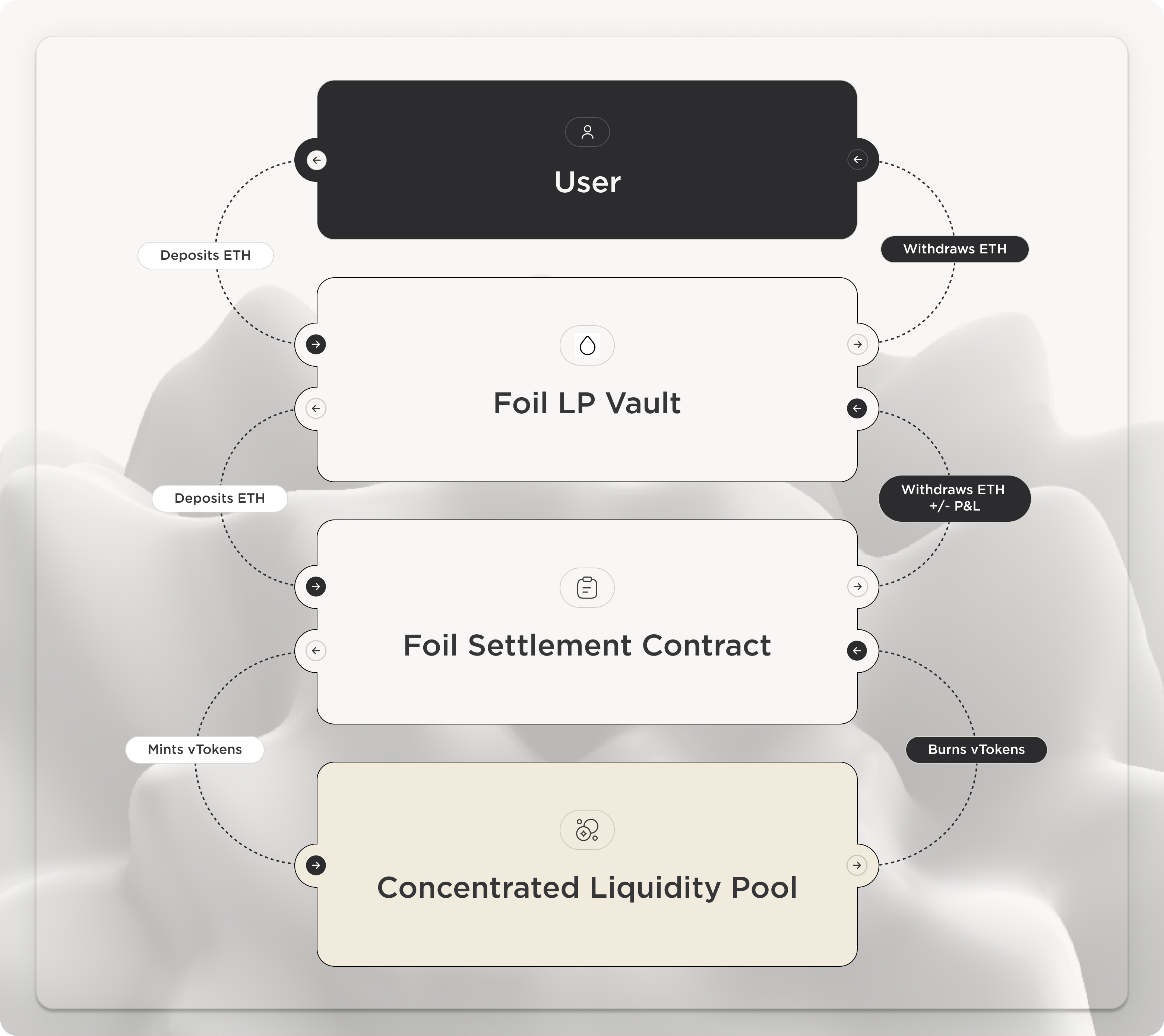

The Foil token vault implementation for L1 will take margin deposits and automatically provide full-range liquidity. This will enable any holder of the Foil token vault to passively earn additional yield on top of LST/LRT base yield.

It is important to note that L1 gas price liquidity provision is attractive to LPs given that gas is highly volatile and tends to mean revert. Additionally, LPs exposure to toxic order flow is minimal given that there is no spot gas market to arbitrage against.